In the evolving landscape of business, one constant remains: the undeniable importance of sound financial management. For any organization, from startups to established enterprises, the path to success is paved with fiscal responsibility, strategic decision-making, and a clear vision of the future. This is where client advisory and accounting services shine as indispensable assets.

Empowered businesses don’t just survive but thrive, and client advisory services (CAS) play a pivotal role in making that a reality. Here are 12 ways in which these services can transform your business, and why they are essential to your financial journey.

1. Financial Record Keeping

Imagine running a marathon blindfolded. Without accurate financial records, your business is in a similarly precarious situation. Accounting services ensure your financial records are not only maintained but are up-to-date and accurate. This meticulous record-keeping is the foundation for tax compliance, financial reporting, and the integrity of your financial data.

2. Tax Planning and Compliance

Tax season doesn’t have to be a source of dread. Our expert accountants are adept at finding tax deductions, credits, and incentives that can minimize your tax liabilities. We also ensure that your business meets all tax filing deadlines, thereby reducing the risk of audits or penalties. With our guidance, you can navigate the labyrinth of tax laws with confidence.

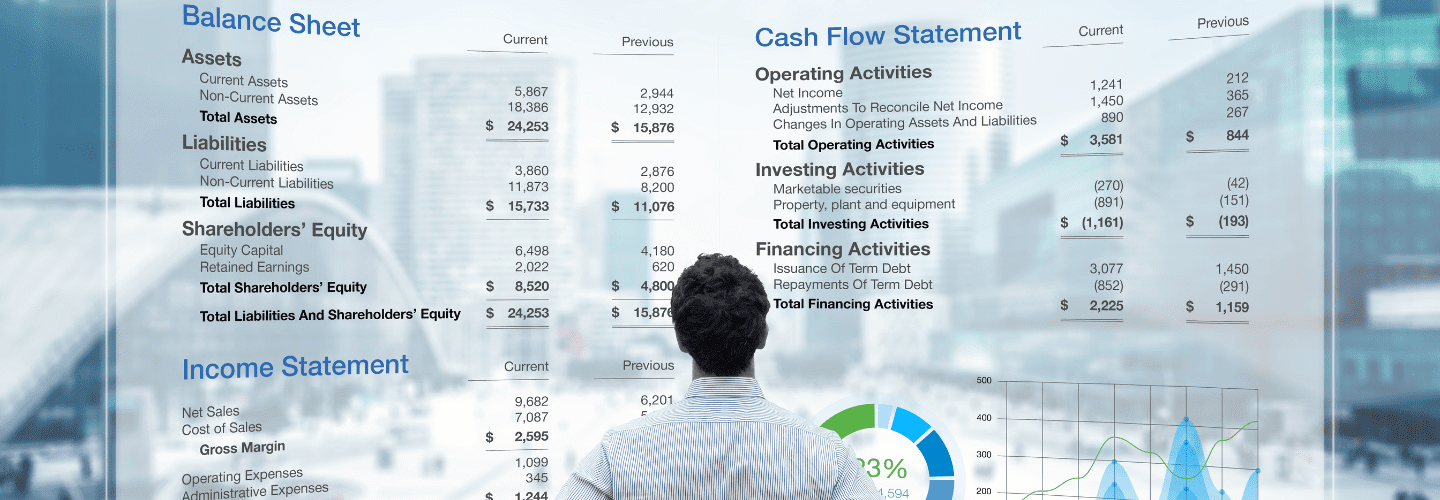

3. Financial Analysis

It’s not enough to have numbers; you need insights. Rea’s accountants and advisors can analyze your financial statements and data to provide valuable insights into your company’s financial health. We identify trends, pinpoint areas of concern, and suggest strategies for improvement, ensuring you make informed decisions every step of the way.

4. Budgeting and Forecasting

Setting sail without a map is risky in the business world. CAS and accounting services help you create and manage budgets and financial forecasts. This allows you to set realistic financial goals, allocate resources effectively, and plan for future growth or challenges. With a clear financial roadmap, you’ll be better equipped to steer your business toward success.

5. Cash Flow Management

Cash is the lifeblood of any business. Rea advisors can help you monitor your cash flow, identify potential gaps, and implement strategies to ensure there’s always enough liquidity to cover expenses and seize growth opportunities. Smooth cash flow management is the key to avoiding financial crises.

6. Financial Decision Support

Major financial decisions, such as investments, financing options, or significant purchases, can make or break a business. Rea advisors provide invaluable guidance and perform financial modeling to assess the potential impact of these decisions on your business. With this kind of expertise, you can make well-informed choices that align with your goals.

7. Risk Management

Navigating the unpredictable waters of financial risks requires a steady hand. Rea advisors can assess risks related to market fluctuations, economic conditions, and industry-specific factors, helping you make informed risk management decisions that safeguard your business’s stability.

8. Business Valuation

For businesses contemplating mergers, acquisitions, or sales, our accounting services can determine the fair market value of your business. This information is indispensable during negotiations and critical to making educated decisions that benefit your bottom line.

9. Compliance and Regulations

The complexities of financial regulations and reporting requirements can be daunting. CAS can ensure that your business remains compliant with local, state, and federal regulations, sparing you legal issues and fines. Peace of mind in regulatory matters is priceless.

10. Economic and Industry Insights

In a world where change is the only constant, staying competitive is paramount. Having fingers on the pulse of economic and industry trends offers you invaluable insights and benchmarks that help your business not only adapt to changing market conditions but also thrive.

11. Financial Strategy Development

Success doesn’t happen by chance. Accounting and advisory services can assist in developing long-term financial strategies that align with your company’s goals. Whether it’s strategies for growth, cost reduction, or profit optimization, our experts will help to get your business exactly where you want to take it.

12. Enhanced Credibility

A well-managed financial profile is not just about numbers; it’s about perception. Properly managed financials and adherence to accounting standards can enhance your business’s credibility and reputation, a valuable asset when seeking investors or financing.

With Rea & Associates by your side, you can navigate the intricacies of business finance with confidence.

Are you ready to take your business to the next level? Contact us today to learn more about how our client advisory services can be tailored to meet your specific needs. Together, we’ll map out a path toward a prosperous future.